MAC Affiliate Conference in Yerevan

Redbridge is honored to have served as the legal advisor for the recent MAC Affiliate Conference in Yerevan.

We are thrilled to have supported Europe’s biggest affiliate conference, which took place on May 30-31, 2024, in the vibrant city of Yerevan. This event brought together over 2500 attendees from 50+ countries, including industry leaders, marketers, and innovators, to discuss the latest trends and developments in affiliate marketing.

Our team at Redbridge provided comprehensive legal guidance to ensure the success and smooth operation of this landmark event. We are grateful to the organizers for their trust and to all the participants for their active engagement and insightful contributions. Witnessing the dynamic exchange of ideas and the collaborative spirit of the conference was truly inspiring.

We look forward to continuing our partnership with the MAC Affiliate Conference and supporting future initiatives that drive progress and innovation.

Gevorg Tumanov appointed to the AMCA’s roster of arbitrators.

He is included in the AMCA's “International arbitration cases” list of arbitrators.

The new rankings are live on IFLR1000.com

We are pleased to inform you, following the in depth research process, peer review, and client feedback, Redbridge has been newly ranked for: Financial and corporate.

Jurisdiction: Armenia

Practice area: Financial and corporate

Redbridge rating: Notable

Lawyers rating (Gevorg Tumanov): Notable practitioner

The ICSID ad hoc Committee’s Decision on Annulment dated 21 July 2023

In ICSID Annulment Proceeding (Edmond Khudyan v. Republic of Armenia) the Members of the ad hoc Committee unanimously decided as follows:

a. The ground for annulment under Article 52(1)(b) of the ICSID Convention has been made out;

b. The Committee concludes that the Tribunal manifestly exceeded its powers and upholds Mr. Khudyan’s application for annulment of parts of the Award under Article 52(1)(b) of the ICSID Convention;

c. Paragraphs mentioned insofar as it concern the Applicant and of the Award are hereby annulled;

d. The funds held in escrow in accordance with the Committee’s decision on the Applicant’s Stay Request, together with all interest incurred thereon, are to be paid to Mr. Khudyan; and

e. The Republic of Armenia shall pay to the Applicant the sums determined by the ad hoc Committee's Decision on Annulment.

Members of the ad hoc Committee:

Sir Christopher Greenwood, GBE, CMG, KC, President

Ms Tina Cicchetti, Member

Dr Ucheora Onwuamaegbu, Member

Representing Mr. Edmond Khudyan:

Hughes Hubbard & Reed LLP

Washington, D.C. 🇺🇸

Redbridge LLC

Yerevan 🇦🇲

CAN BANKS CARRY OUT INTERNATIONAL TRANSACTIONS WITHOUT SWIFT?

What is SWIFT?

SWIFT is a messaging service that substantially facilitates information exchange between banks and other financial institutions. Transactions transmitted via SWIFT are settled by payment systems that facilitate much larger volumes than SWIFT itself. For example, the U.S. Clearing House Interbank Payments System (CHIPS) is owned by large U.S., European, and Japanese banks and facilitates most large-value, cross-border, dollar-denominated payments. This system has internal messaging systems to facilitate payments without relying on SWIFT, but a large share of high-value, cross-border payments involve a SWIFT message.

Who owns and controls SWIFT?

- SWIFT was created by American and European banks, which did not want a single institution developing their own system and having a monopoly.

- SWIFT helps make secure international trade possible for its members and is not supposed to take sides in disputes.

Blocking Sanctions and Delisting from SWIFT

- These measures impose a prohibition on the provision of financial messaging services to delisted banks that are directly or indirectly owned (50% or more) by a delisted bank.

- Banks could carry out international transactions without SWIFT, but it is expensive, complex and requires mutual trust between financial institutions. It brings payments back to the times when telephone and fax were used to confirm each transaction.

Banning Banks from SWIFT

- The ban prevents banks from making or receiving international payments using SWIFT. This has negative consequences for the targeting economy.

- Banks can neither get foreign currency (as a transfer of foreign currency between two banks is generally processed as a transfer abroad involving a foreign intermediary bank) nor transfer assets abroad.

- Block states' foreign exchange reserves and prevents key banks from conducting global fast and efficient financial transactions.

Sanctions against the National Central Banks and assets freeze: Russian case

- As the EU has prohibited all transactions with the National Central Bank of Russia related to the management of the Russian Central Bank's reserves and asset freeze, it can no longer access the assets it has stored in central banks and private institutions in the EU.

- Russia cannot use this cushion of foreign assets to provide funds to its banks and thus limit the effects of other sanctions.

- The EU has also prohibited the sale, supply, transfer and export of euro-denominated banknotes to Russia. The aim is to limit access to cash in the euro by individuals or legal persons in Russia with a view to preventing the circumvention of sanctions.

- Remove Russia's access to capital markets, increase borrowing costs for the sanctioned Russian-owned financial institutions and progressively erode the country's industrial base.

International banks and the direct and indirect effects of financial sanctions

- Direct effect: European banks' equity prices dropped (compared to US banks) and the cost of equity increased. However, credit default swap spreads experienced a more modest decrease, suggesting investors' trust in banks' stability.

- Indirect effects: one of the major indirect effects is the impact on deposit insurance schemes, both in terms of higher bank payments and payouts to customers.

How is this latest ban impacting day-to-day operations within international banks?

- Financial institutions across the globe will be carefully assessing their exposure to Russia.

- Operations and compliance teams will be applying a major focus on accounts and relationships that may have connections to Russian entities and individuals, including politically exposed persons (PEPs).

- Financial institutions will quickly identify which clients (many of which have complex ownership and control structures) have beneficial owners with roots in Russia or exposure to Russian PEPs.

- Automating client due diligence and client behavioral analysis to ensure real-time identification of emerging risks.

Guidelines for compliance with the EU sanctions against Russia

- Sanctions include targeted restrictive measures (individual sanctions), economic sanctions and visa measures. The EU has also adopted sanctions against Belarus and Iran.

Who is being sanctioned?

- In total, also taking into account earlier individual sanctions imposed the EU has sanctioned 1.473 individuals and 207 entities.

What do sanctions on individuals and entities mean in practice?

- Sanctions on individuals consist of travel bans and asset freezes. Sanctions on entities consist of asset freezes. Asset freezes are also prohibited to make any funds or assets directly or indirectly available to them.

How is the EU’s trade with Russia being sanctioned?

- This means that European entities cannot sell certain products to Russia (export restrictions) and that Russian entities are not allowed to sell certain products to the EU (import restrictions).

What EU services to Russia are banned?

- Legal advice, accounting, auditing, bookkeeping, tax consulting services, business and management consulting, public relations services, IT consultancy, architecture and engineering services, advertising, market research and public opinion polling services, as well as product testing and technical inspection services.

What does the oil ban mean in practice?

- The Council adopted a sixth package of sanctions that, among others, prohibits the purchase, import or transfer of seaborne crude oil and certain petroleum products from Russia to the EU. The restrictions apply for crude oil and for other refined petroleum products. A temporary exception is foreseen for imports of crude oil by pipeline into some EU member states. The oil price cap is fixed.

What are the sanctions on transport?

- The EU has prohibited Russian and Belarusian road transport operators from entering the EU, including for goods in transit.

Aviation sector

- All Russian aircraft are banned from overflying EU airspace. No access to EU airports for Russian carriers. The EU banned the export to Russia of goods and technology in the aviation and space industry.

Maritime transport

- The EU has closed its ports to Russia's entire merchant fleet of vessels. However, the measure does not affect vessels carrying some goods.

SWIFT ban for Russian banks

- The ban prevents listed Russian banks from making or receiving international payments using SWIFT.

Sanctions against the Central Bank of Russia

- The EU has prohibited all transactions with the Central Bank of Russia related to the management of the Russian Central Bank’s reserves and assets. As a result of the central bank asset freeze, the central bank can no longer access the assets it has stored in central banks and private institutions in the EU.

Media

- The EU has also imposed sanctions on some media organisations and individuals.

What do EU sanctions against Russia NOT do?

- The sanctions do not block the export of and transactions related to food and agricultural products. EU sanctions explicitly exclude food supplies and fertilisers. The EU has also made some other exceptions within its sanctions.

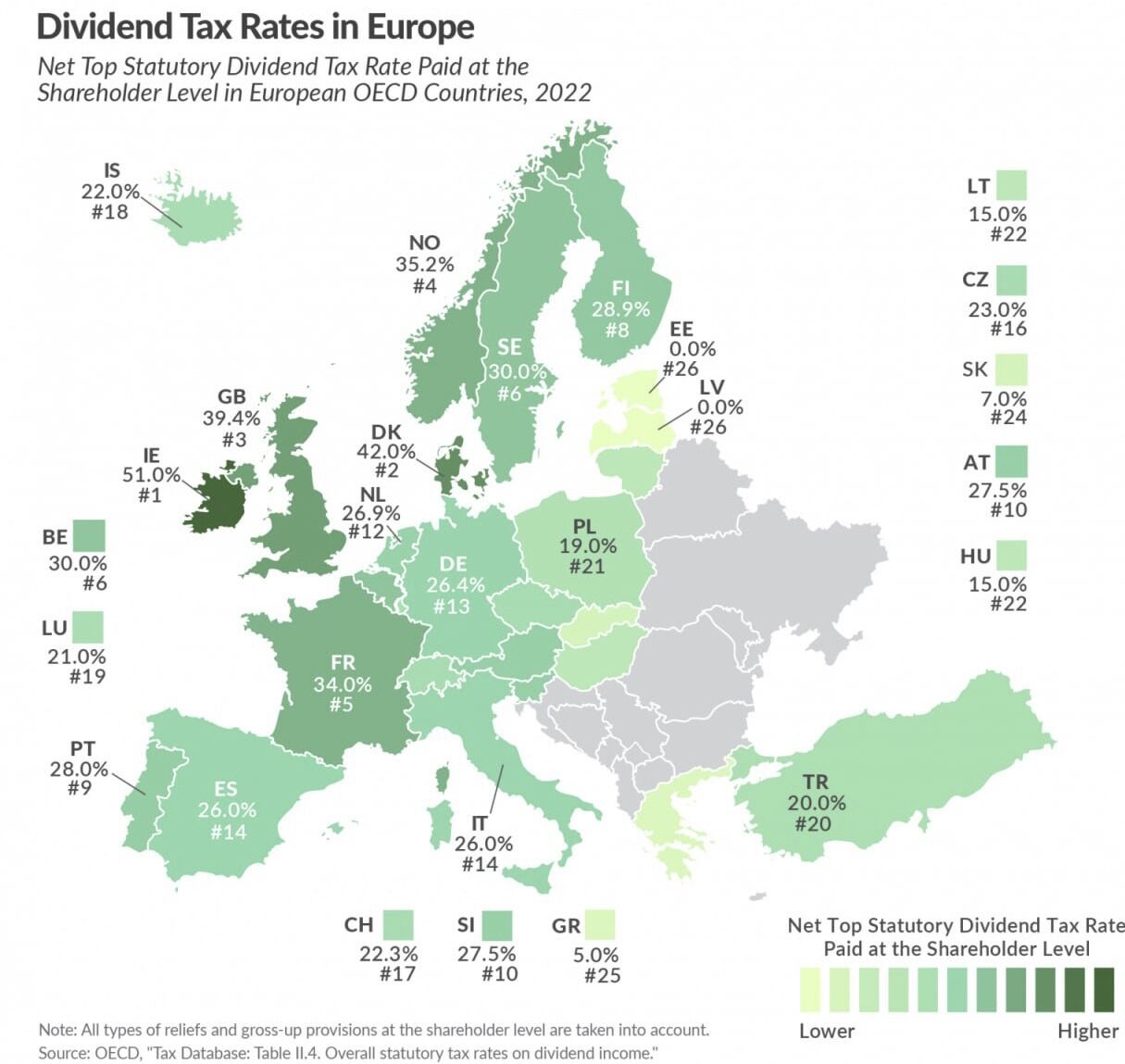

TAXES ON DIVIDENDS IN EUROPE

Among European OECD countries, the highest tax rate on dividends is recorded in:

🔸 Ireland - 51%.

🔸 Denmark - 42%

🔸 UK - 39.4%

✅ The lowest taxes:

🔸 Greece - 5 %

🔸 Slovakia - 7%

❗️Estonia and Latvia are the only European countries that do not impose tax on dividends. When an enterprise distributes profits to shareholders, a corporate income tax of 20% is applied (and paid by the company).

☝️The non-resident is required to declare the dividends paid in the country of a tax residence and pay tax at the rate applicable there.

👉 The fiscal burden can be eased if there is an agreement on the avoidance of double taxation between countries.

The US Government Agencies Point Out New Red Flags

The US Government Agencies Point Out New Red Flags that May Signal Evasion of Russia Sanctions. Common red flags can indicate that a third-party intermediary may be engaged in efforts to evade sanctions or export controls, including the following:

🚩Use of corporate vehicles (i.e., legal entities, such as shell companies, and legal arrangements) to obscure (i) ownership, (ii) source of funds, or (iii) countries involved, particularly sanctioned jurisdictions;

🚩A customer’s reluctance to share information about the end use of a product, including reluctance to complete an end-user form;

🚩 Use of shell companies to conduct international wire transfers, often involving financial institutions in jurisdictions distinct from company registration;

🚩 Declining customary installation, training, or maintenance of the purchased item(s);

🚩 IP addresses that do not correspond to a customer’s reported location data;

🚩 Last-minute changes to shipping instructions that appear contrary to customer history or business practices;

🚩 Payment coming from a third-party country or business not listed on the End-User Statement or other applicable end-user form;

🚩 Use of personal email accounts instead of company email addresses;

🚩 Operation of complex and/or international businesses using residential addresses or addresses common to multiple closely-held corporate entities;

🚩 Changes to standard letters of engagement that obscure the ultimate customer;

🚩 Transactions involving a change in shipments or payments that were previously scheduled for Russia or Belarus;

🚩 Transactions involving entities with little or no web presence; or

🚩 Routing purchases through certain transshipment points is commonly used to illegally redirect restricted items to Russia or Belarus. Such locations may include China (including Hong Kong and Macau) and jurisdictions close to Russia, including Armenia, Turkey, and Uzbekistan.

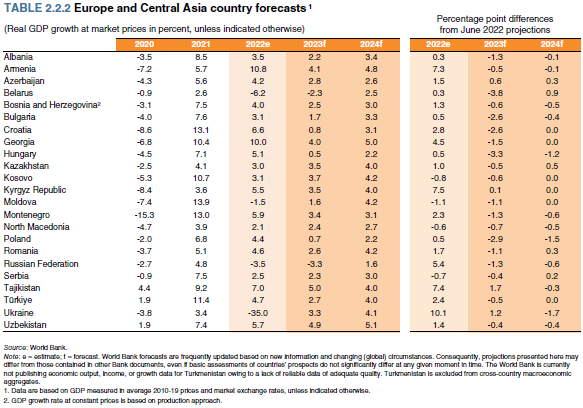

World Bank forecasts economic growth in Europe and Central Asia

The highest economic growth – 10,8% for 2022 in Armenia among European and Central Asian countries. Regarding other regional countries, Azerbaijan’s 2022 growth is at 4,2%, Georgia’s at 10%, and Turkey’s at 4,7%.

New incentives for IT companies in Armenia

Armenia has made the IT sector a priority industry․ The system of granting tax incentives to IT startups first came into force in 2015 based on the law “On State Assistance to the Information Technology Sector”. It is designed to provide IT startups with tax breaks for the first years of their activity. Low rates set under the law are intended to provide motivated behavior for investment and reduce the risk of tax evasion. Tax break certificates are granted on a case-by-case basis by the Special Commission established by the Government.

- They must be trade organizations or Private Entrepreneurs registered in the Republic of Armenia. The certificate cannot be applied to subsidiaries, economic associations, branch offices, or representatives of foreign legal entities.

- The number of employees should not exceed 30

- They shall not sell their fixed assets

- At least 70% of turnover must derive from the types of activities defined above, etc.

In December 2022, amendments were made to the law, as a result of which the benefits program was extended:

✔️Certificate applications will be accepted until November 1, 2023.

✔️ Certificates issued up to and including December 31, 2018, are valid for a period of five years from the date of issuance.

✔️ Certificates issued after January 1, 2019, are valid until December 31, 2023, inclusive.

✔️ The possibility was made to establish other types of state support programs at the suggestion of the competent state body․