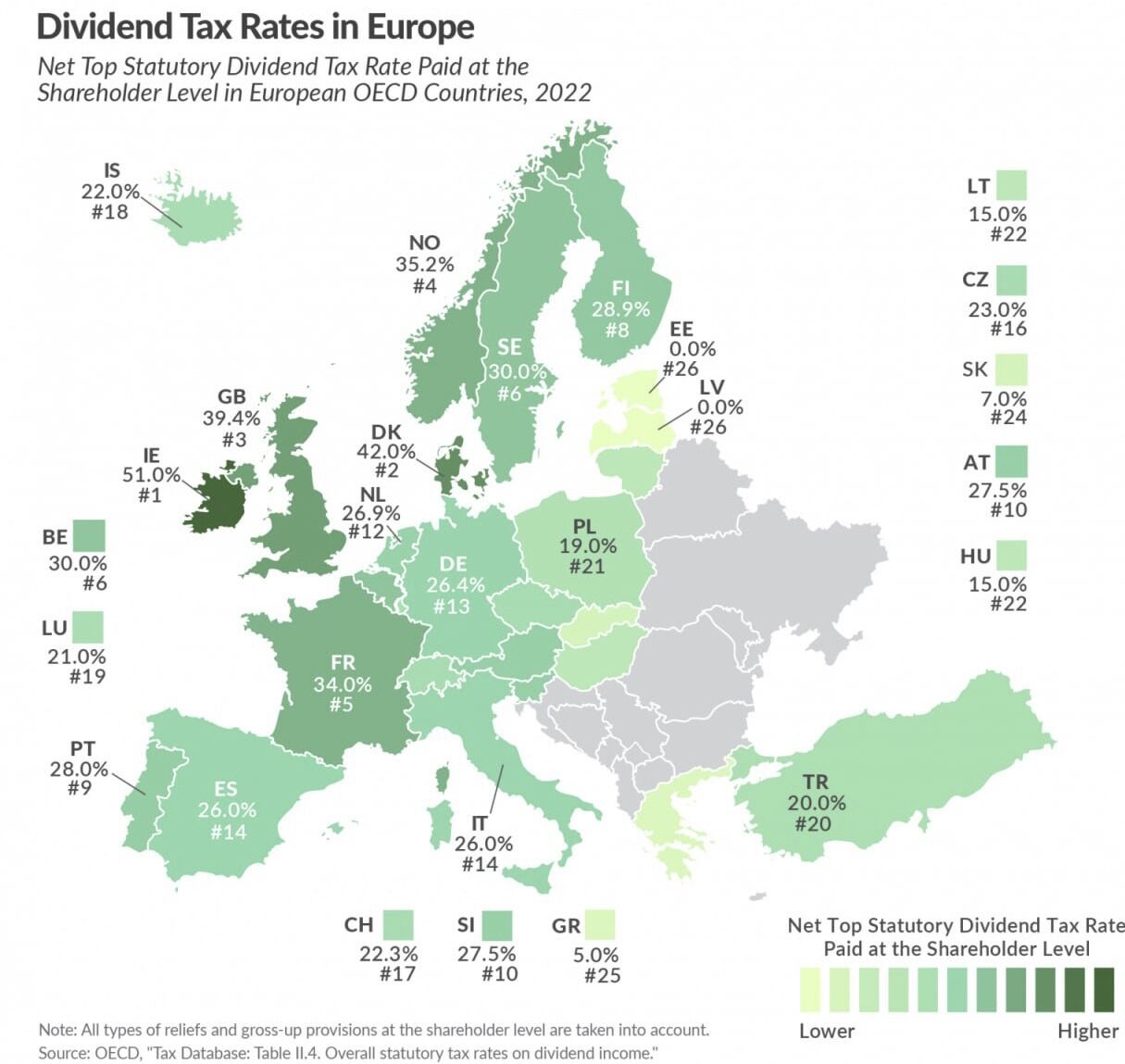

TAXES ON DIVIDENDS IN EUROPE

The map shows the maximum dividend tax rates in OECD countries.✅ The highest taxes:

Among European OECD countries, the highest tax rate on dividends is recorded in:

🔸 Ireland – 51%.

🔸 Denmark – 42%

🔸 UK – 39.4%

✅ The lowest taxes:

🔸 Greece – 5 %

🔸 Slovakia – 7%

❗️Estonia and Latvia are the only European countries that do not impose tax on dividends. When an enterprise distributes profits to shareholders, a corporate income tax of 20% is applied (and paid by the company).

☝️The non-resident is required to declare the dividends paid in the country of a tax residence and pay tax at the rate applicable there.

👉 The fiscal burden can be eased if there is an agreement on the avoidance of double taxation between countries.