KYC and High-Risk Transactions in Armenia

Overview

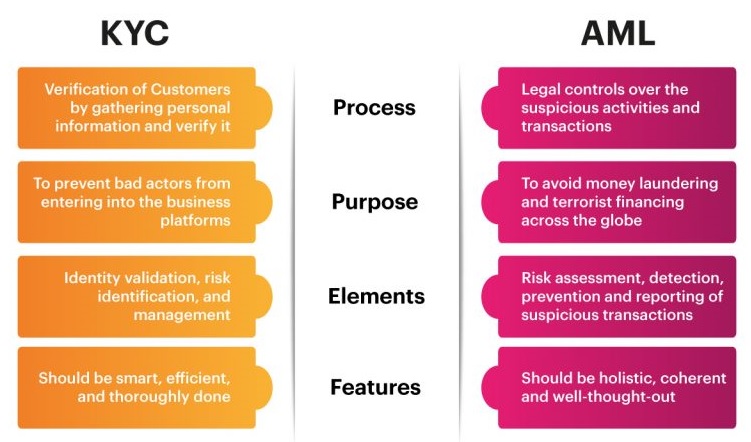

The Republic of Armenia Law on Combating Money Laundering and Terrorism Financing (hereinafter referred to as the “Law”) sets forth the requirements for financial and other institutions in relation to the prevention of money laundering and terrorism financing. Under the Law several categories of institutions, including payment and settlement organizations and other financial institutions have an obligation to develop and implement anti-money laundering and terrorism financing strategies (including KYC procedures) and submit respective reports to the competent authority – the Central Bank.

Payment and settlement organizations shall undertake measures for identifying and assessing potential and existing AML risks (including most importantly a KYC procedure) and shall have efficient policies for managing and mitigating of the discovered risks, control mechanisms and procedures.

High-risk and otherwise regulated transactions. As a reporting entity, a payment and settlement organization shall report to the Central Bank on the transactions and / or business relationships subject to reporting and on all suspicious transactions (with the high-risk transactions mentioned in your inquiry potentially falling under either of those categories).

Transactions subject to reporting are non-cash transactions above the threshold of 20 million Armenian drams (approximately USD 41,650), as well as transaction with cash above the threshold of 5 million Armenian drams (approximately USD 12,250).

According to the Law, a transaction or business relationship is presumed suspicious when there are sufficient grounds to suspect that the asset has proceeded from crime or is linked to terrorism or terrorism financing, or where the transaction involves politically exposed persons or their relatives / affiliates from high risk countries (as determined by the CBA), as well as transactions with unusually high prices or otherwise unusual terms, when the economic or other lawful rationale behind it are not clear. Additionally, according to CBA regulations the following shall be criteria of high risk (which may, but does not necessarily imply that are also suspicious): transaction involves entities or arrangements that are personal asset-holding vehicles, or involves companies that have nominee shareholders or shares in bearer form, relates to businesses and business relationships that are cash-intensive, involves companies that have unusual or excessively complex ownership structure, transaction involve private banking activities, transactions are non-face-to-face business transactions or relationships.

KYC. Within the scope of the KYC procedure, the payment and settlement organization shall identify and verify the customer and the beneficiary (the individual on whose behalf or on whose benefit the customer acts and / or who actually controls the customer or the person on whose behalf or in whose benefit the transaction or business relationship is being carried out). It is generally required to identify the customer in-person, unless the payment to the customer will be made via another financial institution, in which case it is assumed that the latter will perform the in-person identification.

Outsourcing of KYC. Currently Armenian law does not allow to outsource KYC procedures to third parties. There is a possibility for allowing such outsourcing, but it is contingent on CBA regulations, and such regulations are not in place.