International Environmental Law and Armenia

Many countries are working to achieve their environmental objectives by systematically assuring compliance with environmental laws and regulations. In the transition economy of Armenia, this challenge comes at a point when concerted actions are also required to advance the rule of law and the credibility of governments.

A well-functioning system of environmental compliance assurance has a multitude of societal and economic benefits. It protects public health and the environment and helps countries implement environmental policies at lower overall costs. It promotes the rule of law and good governance, as well as the expansion of citizen engagement. Finally, it can boost investor confidence and stimulate the creation of new jobs. The legal and permitting framework has a direct impact on environmental compliance. The quality and clarity of environmental regulations, for example, affect the compliance behavior of regulated entities. A crucial question is whether environmental regulations sufficiently remove the benefits of non-compliance.

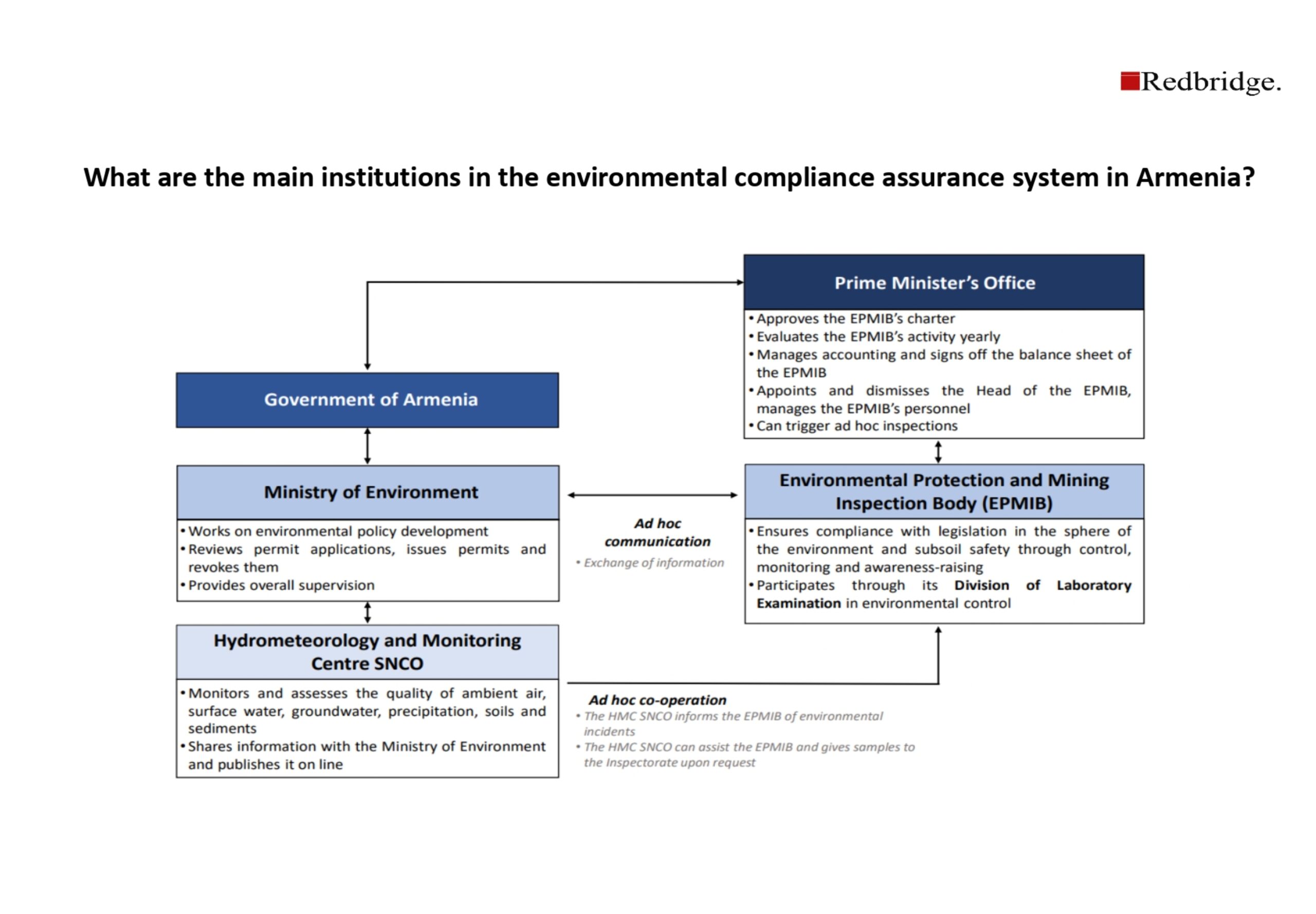

Armenia has in place most laws needed for addressing its environmental problems. Two pieces of recent legislation are noteworthy. The Law on Inspection Bodies, adopted in 2014, sets out key elements of compliance monitoring and enforcement activities across all sectors of the economy. Meanwhile, a Methodology and General Description of Criteria Determining Risks-Based Decree on the Risk Assessment Conducted by the Environmental Protection and Mining Inspection Body of Armenia was adopted in 2019. The methodology established three categories of risk for economic entities and described how to determine risk.

On 1 March 2021, Armenia’s Comprehensive and Enhanced Partnership Agreement (CEPA) with the European Union, signed in 2017, came into force. Draft environmental legislation in the country undergoes public consultation. Armenia ratified the Convention on Access to Information, Public Participation in Decision-Making and Access to Justice in Environmental Matters (the Aarhus Convention) in 2001. It has also been implementing the UNECE Maastricht Recommendations on Promoting Effective Public Participation in Decision-Making in Environmental Matters. Transparency in Armenia’s environmental legislation in the mining sector has improved significantly as a result of the country’s participation in the Extractive Industries Transparency Initiative since 2017. The EPMIB ensures compliance with Armenia’s legislation in the sphere of the environment and subsoil safety.